Australia’s energy transition is facing both pressure and progress.

Yes, key infrastructure projects are running behind schedule. Coal remains a dominant force in the generation mix. And the pace of renewable rollout is falling short of what’s needed to hit national emissions targets.

But momentum hasn’t disappeared. Investment continues. Technology is evolving. And behind the policy noise, businesses are innovating – building hybrid, battery-backed and grid-integrated solutions designed for what’s next.

This is a transition in motion. And for large energy users, the imperative is clear: manage short-term risk while positioning for long-term opportunity.

The federal government is targeting 82% renewable electricity by 2030, a key component of its plan to reduce emissions by 43% from 2005 levels. However, current progress indicates we're behind schedule.

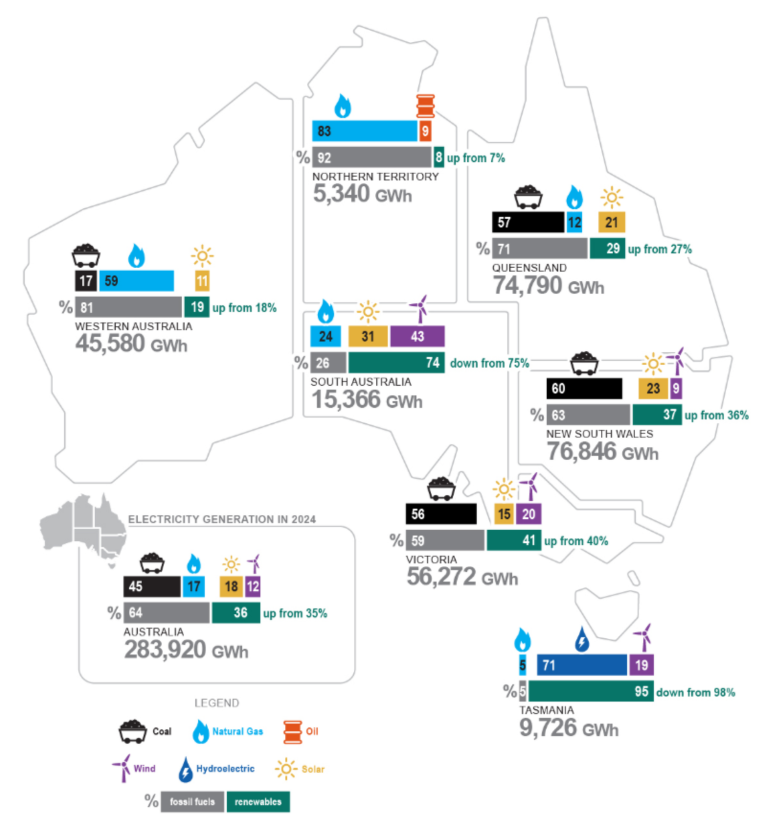

Despite growing investment in solar and wind, according to Australian Energy Statistics, renewables contributed an estimated 36% of total electricity generation in 2024, up just one percentage point from 35% in 2023. The breakdown includes solar at 18%, wind at 12%, and hydro at 5%. Fossil fuels still dominate, accounting for 64% of electricity generation, with coal alone contributing 45% in 2024.

Australian Energy Statistics Infographic June 2025

The transmission infrastructure needed to connect new clean energy is arriving late, sometimes years behind schedule. For instance, the $3.3 billion VNI West project, intended to connect renewable energy zones in Victoria and New South Wales, has been delayed by two years, pushing its completion to late 2030.

These delays are slowing the decline of coal, eating into Australia's emissions budget, and raising serious questions about how we'll replace legacy generation capacity in time.

While delays grab headlines, clean energy investment hasn’t stopped.

Developers continue to push forward with projects across solar, wind, and battery storage – increasingly in hybrid or co-located configurations. Australia's Renewable Energy Zones (REZs) are attracting interest despite connection challenges, and new generation continues to be added to the pipeline.

There’s also growing emphasis on firming, flexibility, and demand-side solutions:

Every delay adds complexity to an already volatile market. Whether you’re preparing for a major procurement, planning a decarbonisation pathway, or managing large energy loads across sites, these are the signals to watch:

While Australia's energy transition may be stalling more broadly, there’s no reason for your business to wait. This is your window to get ahead while others hesitate. Utilizer works with energy-intensive businesses to navigate these decisions – turning market complexity into clear strategy, and insight into action.

At Utilizer, we help commercial and industrial energy users cut through the noise. We monitor the energy market daily, help you decode your energy data, and design procurement strategies that align with your risk appetite, carbon goals, and operational needs.

Whether you’re preparing for contract renewal or exploring on-site generation, Utilizer is here to help you move ahead with clarity. Get in touch for tailored advice and a clear path forward.

More power to you.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.