Yallourn Power Station has been keeping Victoria’s lights on for nearly a century. At its peak, six units pumped out coal-fired power from the Latrobe Valley. Today, just four remain, delivering around 22% of Victoria’s electricity and 8% of the NEM.

But here’s the uncomfortable truth: Yallourn isn’t the reliable baseload giant it once was. It’s limping. Ageing gear, costly fixes, and a track record of unplanned outages are all stacking up. So the question isn’t just can it make it to 2028? It’s what happens if it doesn’t?

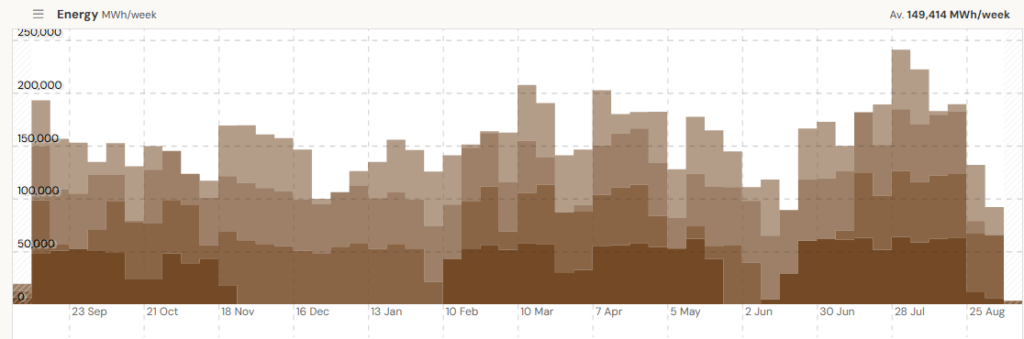

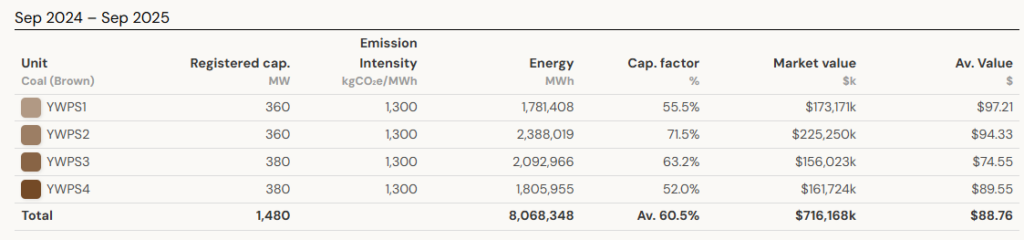

Source: Open Electricity

According to Open Electrcity, Yallourn averaged 149,414 MWh/week over the past year. Sounds solid, right? Until you look closer.

Source: Open Electricity

This isn’t the definition of “baseload". This shift from “always on” to “patchwork operation” is a stark sign of structural decline – and one that energy buyers increasingly need professional energy consultants to help navigate.

Yallourn’s patchy data is reinforced by a string of recent failures:

This is a power station held together with patches and prayer. And while it coughs and splutters, demand keeps rising. Energy procurement experts will tell you: don’t assume this plant will always be there to catch the load.

Every outage hits the market like a hammer:

Let’s be real. The closure date is 2028, but Yallourn might bow out early — or simply collapse under its own weight.

If that happens:

That’s why energy consulting isn’t just a nice-to-have right now. It’s about staying in front of a risk that could turn into a system-wide crisis with one bad summer.

Yallourn is running out of road. The question isn’t whether it makes it to 2028. It’s whether businesses can afford to sit back and hope it does.

For commercial energy users, the move is clear:

At Utilizer energy consultants are working with businesses to cut through this uncertainty, using energy procurement strategies and energy management services to reduce exposure and give clients real options. Yallourn is today’s headline, but the bigger play is how you position for the system that’s coming. We can help with that, let's talk.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.