The Essential Services Commission (ESC) has finalised the Victorian Default Offer (VDO) for 2025–26, to commence on July 1st. At first glance, it’s a modest update. But beneath the surface, it reveals deeper shifts in electricity market dynamics, regulatory sentiment, and cost exposure that businesses, especially those managing embedded networks or operating multi-site portfolios, cannot afford to ignore.

While these changes may seem minor, they reflect larger structural increases in network and wholesale electricity costs and highlight changes in how retailers are expected to manage risk.

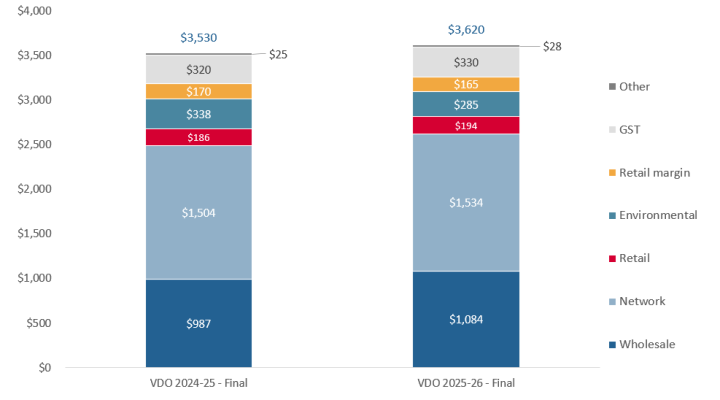

Source: ESC - Change in the average Victorian Default Offer annual bill by cost component, for small business customers with annual usage of 10,000 kWh, $ nominal

Network charges, regulated by the Australian Energy Regulator (AER), now make up around 35 to 40 percent of a typical small business energy bill. This year, they rose by an average of 4%, with variations depending on location, demand profile, and infrastructure requirements.

The ESC has changed how it calculates wholesale electricity costs:

This change better reflects how retailers actually buy electricity from the wholesale market. It also makes Victoria’s approach more consistent with other states. For businesses with solar or embedded networks, it could affect how feed-in tariffs are set and how retailers price their offers, especially during times of high solar exports.

There’s been a small reduction in environmental scheme costs, thanks to lower federal liabilities and the removal of the social cost of carbon. These are charges retailers face to comply with government schemes like the Renewable Energy Target (RET) and the Victorian Energy Upgrades (VEU) program, which are passed through to customer bills. A reduction in these costs offers slight relief, but they remain a minor part of overall energy spend.

The default retail margin has been reduced to 5%, down from 5.3%, with the aim of keeping default offers reasonable while maintaining retail market sustainability. This margin represents the allowable profit retailers can earn on default contracts, so a lower margin puts downward pressure on standing offer prices but may also reduce retailer flexibility or appetite for low-margin customers.

Whether you manage a strata portfolio, operate an embedded network, or oversee a multi-site energy strategy, here is what you should take away from this year’s Victorian Default Offer.

Small price changes might not look like much, but they can hide bigger risks in the background. Wholesale electricity costs have gone up slightly this year, and the market remains unpredictable. If your business is on a standing offer or near the Victorian Default Offer, you could be paying more than you need to without any added protection from market swings.

What Utilizer Can Do For You:

The shift to import-only load modelling and the introduction of export costs mean retailers will change how they price contracts for solar customers. This is especially true in zones with high solar uptake like Powercor and AusNet.

What Utilizer Can Do For You:

You can't negotiate network tariffs, but you can work around them. With the ESC passing through higher AER-approved tariffs, tariff class, demand patterns, and load timing now have a significant role in managing cost. These factors influence how charges are applied, meaning the same usage can result in very different bills depending on how and when electricity is consumed.

What Utilizer Can Do For You:

Retailers are dealing with narrower margins and more complex risk modelling. That may mean fewer discounts, stricter conditions, and less flexibility unless you are actively negotiating. As retailers adjust to tighter operating conditions and evolving cost structures, they are likely to be more selective about pricing and contract terms, especially for higher-risk or passive customers.

What Utilizer Can Do For You:

The Victorian Default Offer is not designed to deliver competitive pricing. It exists to protect disengaged customers. For businesses managing multiple sites or embedded networks, it may provide a useful benchmark, but it should not be mistaken for a cost-effective solution.

At Utilizer, we help our clients move beyond default thinking by turning insight into action. We help you navigate complex cost structures, procurement opportunities, and market shifts to secure the best-available outcomes. Reach out today and let’s make sure you're not paying more than you need to.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.