Between Sunday 8 June and Friday 13 June 2025, Victoria consumed more than 4,668 terajoules (TJ) of gas for gas-fired electricity generation. This is a striking figure given that the Australian Energy Market Operator (AEMO) had forecast just 5,600 TJ for the entire year under its central scenario, outlined in the 2025 Gas Statement of Opportunities (GSOO). This means over 83% of the forecast has been used in just 5 days.

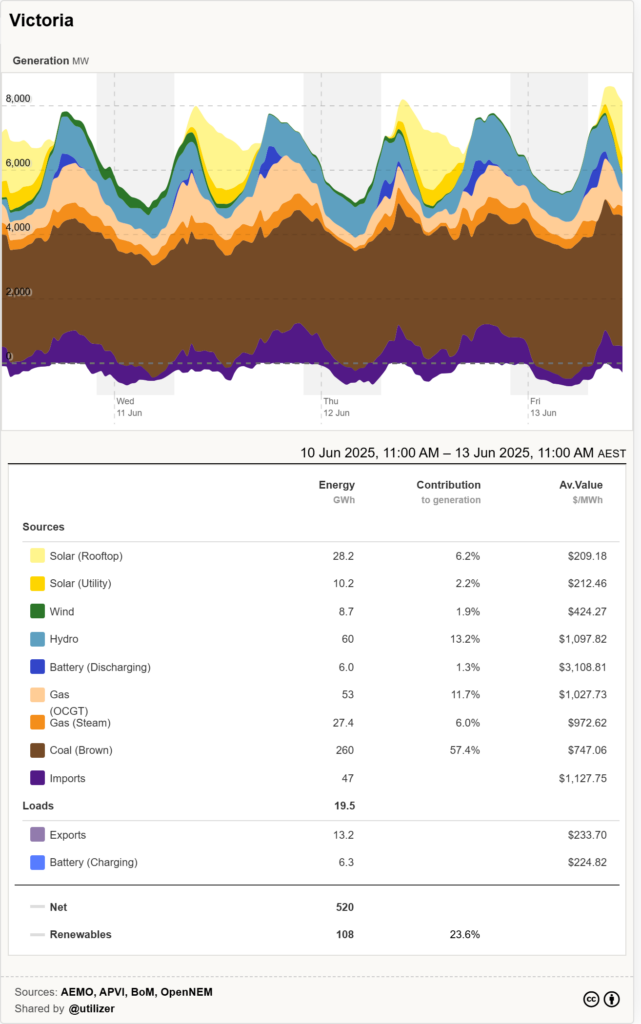

This unexpected surge was driven by a perfect storm: multiple coal generator outages, unseasonably cold weather, and reduced output from wind. As a result, gas-fired electricity generation (typically used as a balancing mechanism) became the system’s primary source of firm capacity.

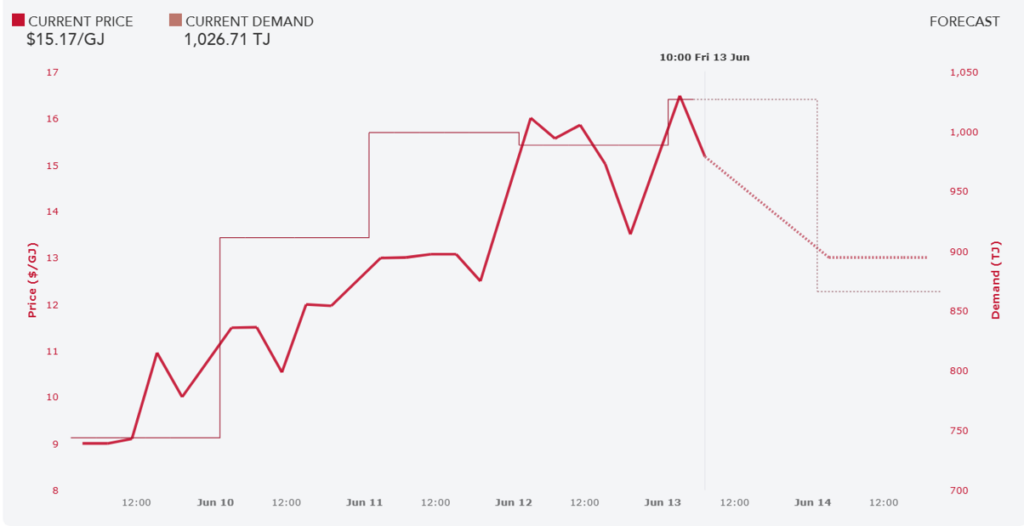

Electricity demand spiked across the state during the same period, driven by cold conditions and reduced supply-side flexibility. Simultaneously, gas demand for electricity generation peaked at 1,026.7 TJ on the morning of Friday 13 June, the highest daily total so far this winter.

As reported by the Australian Financial Review, by the end of Tuesday 10 June, Victoria had consumed more than 13% of the 5,600 TJ gas usage forecast in AEMO’s 2025 central scenario within 3 days. The three-day total marked one of the largest gas usage surges for electricity generation in over a decade, driven by a combination of unseasonably cold weather, minimal renewable output, and the major outages at key coal-fired generators. By Friday morning, total gas use over the five-day period had climbed to more than 4,668 TJ, bringing Victoria close to its full-year forecast in less than a week.

Throughout the week:

While wind generation was very low, solar held steady during the day. It kept contributing through the middle of each day, helping to support electricity supply and ease pressure on prices.

On the whole, it reduced how much gas was needed. At night, gas supplied 15–30% of electricity, but during the day, that dropped to 8–15%, even though demand stayed about the same at 7–8 GW.

Without solar to reduce the need for gas during the day, we can assume that even more gas would have been used and prices would have been higher overall.

The energy system strain triggered sharp price movements across both electricity and gas markets:

Victorian Wholesale Gas Market - Snapshot

Source: AEMO

Despite the intensity of the system conditions, AEMO confirmed that electricity reserves remained sufficient, and gas storage levels were high, thanks to proactive filling ahead of winter.

As reported in The Australian, Michael Gatt, AEMO’s Executive General Manager of Operations, acknowledged the role gas continues to play in safeguarding system reliability:

“Recent conditions in Victoria highlight the role gas plays in the [National Electricity Market] as the ultimate reliability backstop when ageing power station unavailability coincides with low renewable output.”

- Michael Gatt, quoted in The Australian

While the state continues to progress towards electrification, the events of this week demonstrated that gas remains critical during periods of low renewable output and unexpected outages.

AEMO forecasts indicate that wind generation is expected to rebound from Friday night, with output potentially reaching up to 80% of capacity on Saturday. This increase is expected to ease pressure on gas-fired generation and stabilise electricity prices in the short term.

However, the events of this week have reinforced a critical tension in Victoria’s energy transition: while the state is actively pursuing electrification and a reduction in gas reliance, gas remains essential during periods of low renewable output and system stress.

In public comments reported by The Australian and the ABC, a Victorian Government spokesperson reaffirmed that no formal concerns had been raised by AEMO about gas supply for winter. The spokesperson reiterated that gas is still part of the state’s transition strategy:

“We’ve always said gas is part of our energy transition – but legacy supplies from Victoria’s Bass Strait are dwindling and prices are going up. That’s why we’re looking at ways to secure new supply while also helping Victorians switch to electric appliances.”

- Victorian Government spokesperson, via The Australian

With Yallourn scheduled to close by 2028 and Loy Yang A by 2035, the state’s reliance on ageing baseload generation is fast approaching a critical point. Without timely investment in firming capacity, storage, and demand-side flexibility, even short-lived supply shocks, like those seen this week, will continue to expose vulnerabilities in the grid.

At Utilizer, we help businesses make informed, confident energy decisions, even in volatile conditions like these. If your organisation is exposed to gas or electricity market risk, or you're exploring the transition away from fossil fuels, we’re here to support you with clear advice and tailored strategies.

Get in touch to speak with one of our expert energy consultants and find out how we can help you navigate the market.

More power to you.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.