We’re often told Australia is an energy superpower but, if you’re a business on the east coast, it doesn’t always feel that way.

A recent article in the Australian Financial Review explored the growing frustration over gas prices, highlighting just how stark the divide is between east and west. And while federal intervention is being floated, the solutions aren’t as straightforward as they might sound.

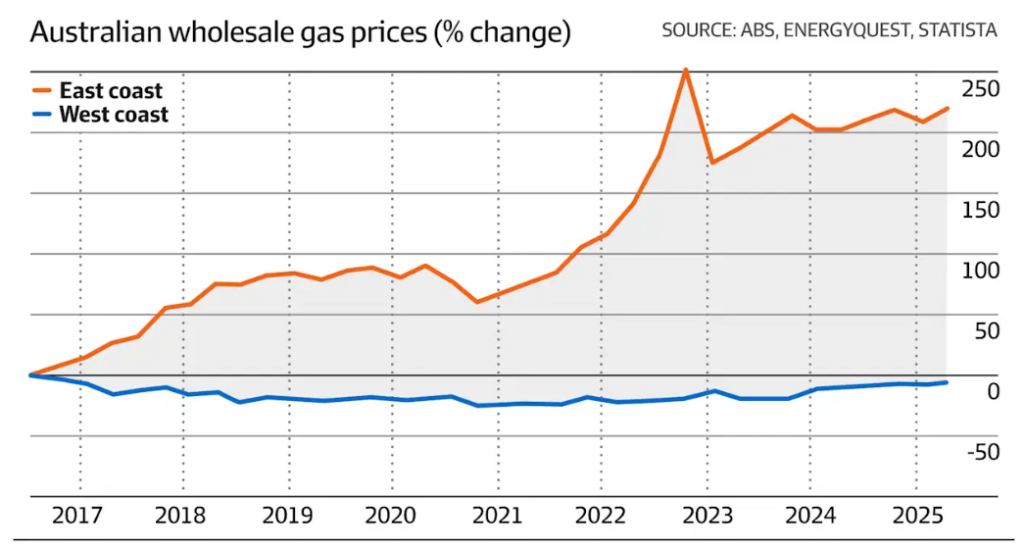

New analysis from EnergyQuest shows wholesale gas prices on the east coast have tripled over the past decade. In Western Australia? They’ve barely moved.

Secondary Source: AFR

The obvious difference lies in WA’s domestic gas reservation policy. Producers are required to set aside 15% of their output for local use, creating a supply buffer that’s kept gas prices relatively stable. The east coast, on the other hand, has no such safety net. Much of the gas is locked up in long-term export contracts, and there’s been consistent pushback from southern states against new exploration and development.

WA’s policy works because it’s backed by long-term political alignment, investment in infrastructure, and a willingness to develop supply. That mix simply doesn’t exist in the east.

Instead, we’re dealing with:

So while it’s tempting to say “just do what WA does,” the reality is more complex. You can’t reserve a gas supply that hasn’t been developed. You can’t ease gas prices if there’s no capacity to move or store it. And you can’t build policy certainty if the levers are split across jurisdictions.

Some policymakers have claimed that Australians are paying among the highest gas prices globally. But EnergyQuest’s analysis tells a more nuanced story.

Yes, gas prices on the east coast are high, but they’re not the highest in the developed world. In fact, excluding North America (which has unique supply and pricing dynamics), most other developed countries are paying more, particularly across Europe and Asia.

That said, the public perception of unfairness remains strong. In May, Resources Minister Madeleine King called it “unfair” that Australia exports so much gas while local users face high prices. Prime Minister Albanese also praised WA’s approach during a visit to Perth, suggesting a possible shift in federal policy thinking.

A WA-style scheme is reportedly on the table as part of the federal review but, even if something is introduced, it’s unlikely to apply to existing export contracts. That limits the impact from the outset.

The reality is, you can’t reserve what isn’t there. Without new supply coming online, a reservation policy might look good on paper but it may not shift gas prices in any meaningful way. It could risk becoming more of a political statement than a practical solution.

For commercial and industrial energy users, this isn’t just a policy debate. It has real implications for cost certainty and contract strategy. The outcome of the review could shape future market dynamics, but it won’t deliver immediate relief.

At Utilizer, we’re focused on helping clients navigate today’s uncertainty while preparing for tomorrow’s shifts. That means looking at contract timing, building flexibility into portfolios, exploring storage and hedging strategies, and keeping a close eye on regulatory developments.

The east coast vs west coast divide isn’t just a pricing gap. It’s a structural challenge. And for businesses, the best move right now is to stay informed, stay flexible, and stay ahead of the policy curve.

There’s a lot still unfolding, and no one-size-fits-all answer. If you want to sense-check your current approach or talk through what this could mean for your business, reach out to us today.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.