Australia’s gas market is under pressure. Structural supply issues, increasing volatility, and the growing risk of shortfalls are now being compounded by policy conversations that are rapidly evolving.

Over the past fortnight alone, we've seen:

From our position at Utilizer, as expert energy consultants, we see this evolving conversation as a clear signal to prepare. Gas supply is tightening, political and regulatory responses are accelerating, and investment timelines, weather volatility, infrastructure constraints, and electrification trends are all reshaping how businesses need to think about energy planning and risk management.

Here are some of the key takeaways:

The ACCC’s Interim update on east coast gas supply-demand outlook for quarter 3 of 2025 warns that gas supply for Q3 (July–September) could swing from a 6 PJ surplus to a 9 PJ shortfall—within months. The key variable? Whether LNG exporters retain uncontracted gas for the domestic market or send it offshore.

Source: ACCC analysis of data obtained from gas producers in January 2025 and of the domestic demand forecast (Step Change scenario) from AEMO, Gas Statement of Opportunities, Gas Statement of Opportunities, March 2025. NB: Totals may not sum due to rounding.

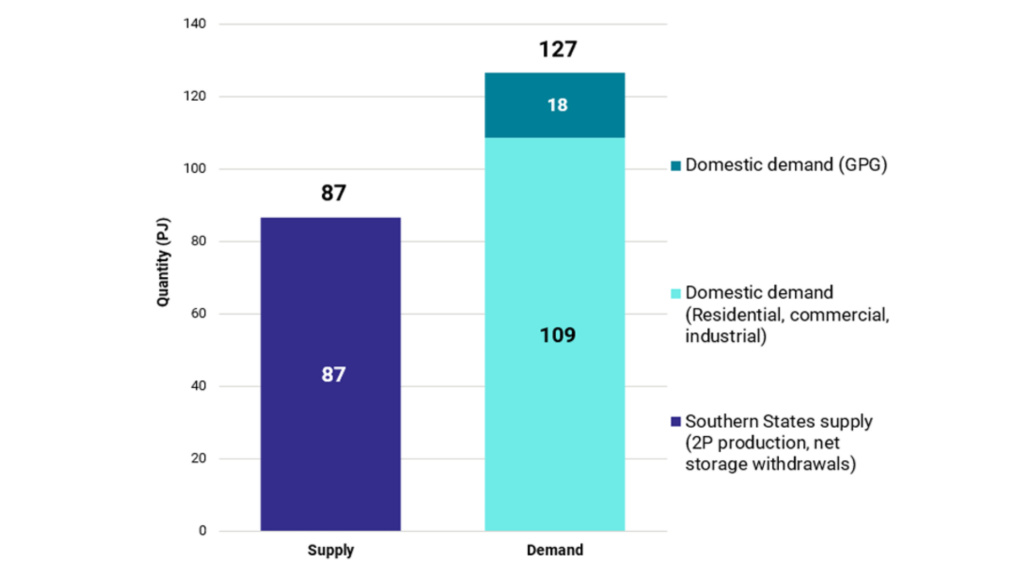

The southern states are projected to face a 40 PJ shortfall, the largest on record. While pipeline capacity exists to move gas south, the market lacks the flexibility to handle added pressure from cold weather, outages or export behaviour shifts.

The ACCC emphasises that Iona storage must be near full by May to meet expected winter demand. Any delay in charging storage increases the risk of disruption under peak conditions.

The ACCC has urged LNG producers to voluntarily redirect up to 15 PJ of uncontracted gas to the domestic market. If this doesn’t occur, it has flagged possible activation of the Australian Domestic Gas Security Mechanism (ADGSM).

While residential and commercial gas use is expected to drop over time due to electrification and fuel switching, the scale and speed of that decline remain uncertain. Industrial gas use is projected to remain steady, and electricity generators may still need to draw on gas during peaks.

A one-year delay from previous forecasts, driven by lower consumption expectations, temporary coal plant extensions, and new southern supply developments. This shift reflects lower demand forecasts, a temporary extension of coal generation, and new southern supply developments.

It's projected that existing and committed gas supplies are no longer sufficient to meet annual demand under most scenarios by 2029. There are a number of potential solutions that could help delay supply gaps until 2033 or 2034. New gas fields, pipeline upgrades, LNG regasification terminals, and expanded storage are all being considered. While each option can delay shortfalls, a combination will likely be required to maintain long-term adequacy. All options face regulatory hurdles, investment risk, and delivery timeframes, making early action essential.

In a pre-election policy announcement, Opposition Leader Peter Dutton proposed that, if elected, a Coalition government would introduce a gas reservation policy on the east coast, similar to Western Australia’s existing model. The goal: prioritise domestic supply to protect households and Australian industry.

Source: ABC News

The proposed reservation would apply to new east coast gas developments, not existing fields. This is designed to avoid disrupting current contracts while securing future supply.

Dutton directly criticised LNG exporters, suggesting they are not doing enough to meet domestic needs and are instead prioritising profits from exports.

If elected at the polls in May, the Coalition would back further development in key basins such as the Beetaloo and Bowen, and commit to removing barriers to fast-track new supply.

Dutton stated that a Coalition government would be prepared to intervene in the market if exporters failed to provide fair and adequate supply to Australians.

While the GSOO has pushed peak day shortfalls back to 2028, the ACCC warns of real risk emerging as early as winter 2025, particularly in the southern states. This temporary reprieve on paper doesn’t address the structural challenges ahead. From 2029, the GSOO confirms a long-term supply gap—making it critical for businesses to act now, not later.

Gas demand is becoming increasingly weather-sensitive and tied to electricity system stress. At the same time, the policy environment is becoming more interventionist. With proposals like the east coast gas reservation policy now on the table, businesses should anticipate a more reactive and regulated market, and plan accordingly.

The southern states—particularly Victoria—remain the most exposed. A tightening supply-demand balance, lower local production, and storage constraints heighten risk. Understanding where your operations sit in relation to these regional pressures is key to building the right energy strategy.

The case for reviewing your business’s reliance on gas is stronger than ever. Whether it’s through electrification, efficiency gains, or fuel-switching, now is the time to assess how you can reduce risk and improve resilience. A well-timed shift won’t just support decarbonisation—it can also buffer your business against increasing market volatility and supply uncertainty.

If your business relies on gas, recent developments from the GSOO, the ACCC and federal policymakers make one thing clear: it’s time to get proactive.

At Utilizer, we work with organisations to navigate uncertainty and plan ahead—whether you're managing immediate risk or looking at the bigger picture. Here's how we can support you:

The energy landscape is shifting, but with the right strategy, your business can stay steady and in control.

The GSOO, ACCC report and recent policy announcements don’t just highlight the challenges facing the gas market—they underscore how interconnected and fast-moving the landscape has become. But as with all transitions, the path forward is complex. Infrastructure takes time to deliver. Regulatory processes can be lengthy. And the energy landscape continues to evolve at pace.

In this environment, energy agility isn’t just a nice-to-have—it’s a strategic advantage. Businesses that are prepared, informed, and adaptable will be best placed to navigate what’s ahead.

If you’d like to discuss how these developments affect your business—or explore ways to future-proof your gas and energy portfolio—we’re here to help. Reach out to our expert team today.

Heatwaves and the Energy Market

January 13, 2026

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.