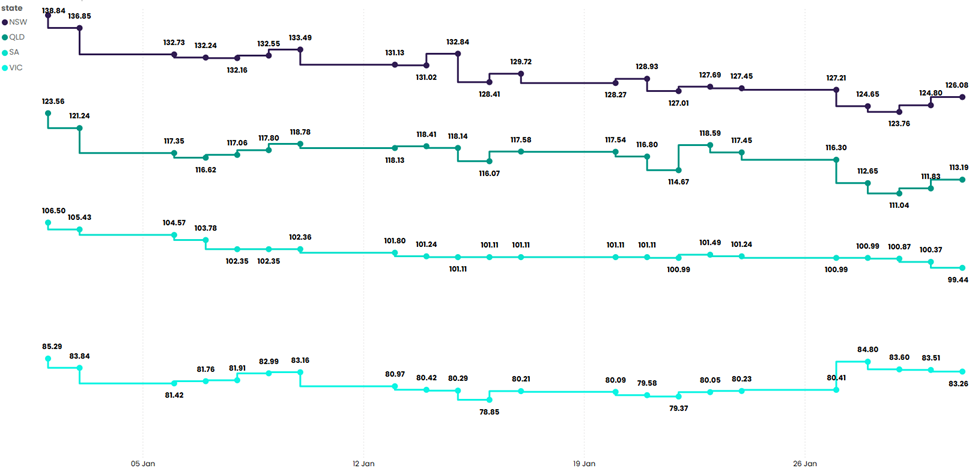

January saw a notable decline in electricity futures prices across the National Electricity Market (NEM), with reductions in all states and an ongoing trend of negative pricing events in regions with high renewable penetration.

Electricity Prices

Negative Pricing Events

Victoria and South Australia continued to experience frequent negative pricing events, a trend that reflects the growing impact of renewables on wholesale electricity markets.

As more renewable energy projects come online, negative pricing events are expected to increase. This presents opportunities for businesses to adopt flexible energy procurement strategies, take advantage of demand-response incentives, and consider battery storage solutions to optimise cost savings.

Source: ASX Energy Futures

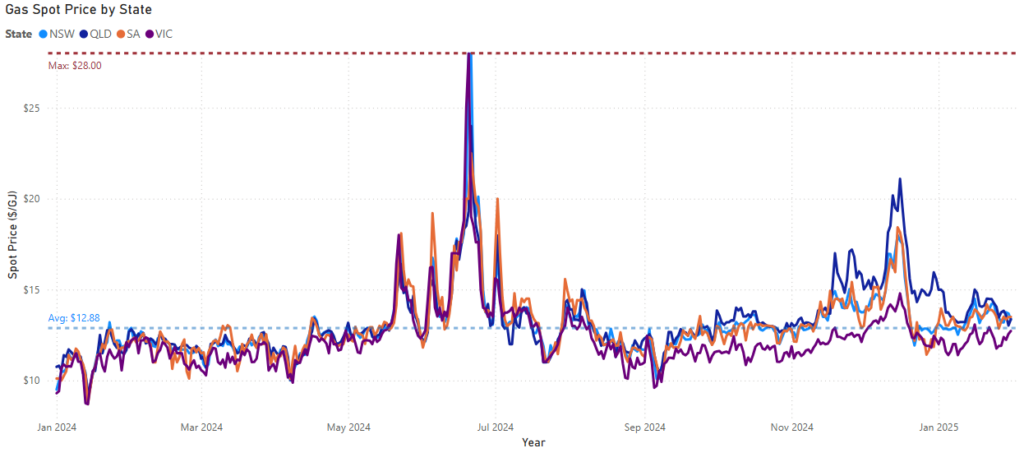

Wholesale gas prices steadily declined in January, averaging 9% lower than December 2024. The decline was driven by several factors:

While the downward trend benefits gas-reliant businesses, ongoing regulatory discussions about gas price caps and supply security may lead to fluctuations later in the year.

Source: AEMO STTM and DGWM Spot Market Data

With electricity prices declining across the NEM, businesses have an opportunity to lock in more competitive energy contracts. However, the ongoing trend of negative pricing events in Victoria and South Australia underscores the opportunity for strategic energy use, such as shifting consumption to periods of lower pricing or investing in battery storage solutions. Meanwhile, lower gas prices provide some relief for energy-intensive industries, but regulatory uncertainty around long-term gas supply means businesses should consider hedging strategies or diversifying their energy mix to mitigate future risks.

February saw renewed speculation around a potential $3 billion acquisition of Alinta Energy by an international investment firm. Industry analysts suggest that Alinta’s strong market position and growing customer base have made it an attractive target for mergers and acquisitions. If a deal does proceed, it could mark a transformation in the energy retail market, with potential changes to pricing strategies, customer offerings, and operational efficiencies.

Key Takeaways:

What does this mean for you?

While the acquisition remains speculative, businesses should stay informed about potential ownership changes and how they might impact energy pricing and retail competition. At Utilizer, we continuously monitor these market developments to help businesses assess risks and opportunities in energy procurement. If the acquisition moves forward, it could influence contract structures, pricing strategies, and the competitive landscape, making it crucial for businesses to remain agile in their energy management approaches.

The NSW Government has launched the Energy Security Corporation's first Investment Mandate. Seeded with $1 billion, this initiative aims to co-invest with the private sector in critical renewable energy projects that will enhance reliability, affordability, and sustainability across NSW. By addressing investment gaps and ensuring the smooth operation of the energy grid, the Energy Security Corporation will play a pivotal role in the state’s transition towards a more resilient and decarbonised electricity network.

Key Takeaways

What does this mean for you?

The Energy Security Corporation’s mandate creates significant opportunities for businesses to participate in and benefit from NSW’s renewable energy expansion. Companies based in NSW that invest in battery storage, demand-response programs, or Virtual Power Plant (VPP) participation may be able to access government-backed funding and incentives. At Utilizer, we help businesses understand how these evolving policies impact their energy strategy, from securing cost-effective procurement deals to integrating sustainability initiatives.

Woodside Energy has secured environmental approval from the Western Australian Government to extend the operational life of its North West Shelf (NWS) liquefied natural gas (LNG) project until 2070. This decision, concluding a six-year assessment and appeals process, is pivotal for the continued processing of gas resources through the Karratha Gas Plant, ensuring a stable energy supply for both domestic and international markets.

Key Takeaways:

What does this mean for you?

Woodside’s LNG extension secures long-term gas supply in WA, but businesses should monitor regulatory changes that could impact pricing and contracts. Staying informed will help mitigate risks and optimise procurement strategies.

Former ACCC Chair Rod Sims has renewed his warnings about gas shortages and energy security risks in Victoria, highlighting a decade of missed opportunities to prevent supply constraints. Sims revealed that since 2015, the ACCC had repeatedly cautioned both federal and state governments about looming gas shortages due to Victoria’s restrictive policies on exploration and development. Despite clear evidence from industry reports and policy recommendations, little action was taken, leading to today’s supply challenges, rising prices, and increased risks to energy reliability.

Key Takeaways:

What does this mean for you?

Businesses reliant on gas and electricity should prepare for continued price volatility and potential supply disruptions. The ongoing transition away from coal, combined with limited new gas developments, underscores the need for strategic energy planning. Utilizer helps businesses navigate these risks by identifying cost-effective procurement strategies, evaluating alternative energy sources, and ensuring resilience in a rapidly shifting energy landscape.

Falling electricity prices present opportunities for businesses to secure competitive contracts, while negative pricing events in high-renewable regions emphasise the need for flexible energy strategies. Meanwhile, regulatory approvals for LNG projects and warnings from former ACCC Chair Rod Sims underscore the long-term risks of gas supply shortages and market volatility. As Australia navigates the challenges of energy transition, businesses must stay informed and proactive in managing their energy procurement and risk strategies.

At Utilizer, we provide expert insights and tailored solutions to help businesses optimise costs and secure energy resilience. Contact our team today to explore how you can future-proof your energy strategy in a changing market.

AEMO’s Toolkit for Australia’s Energy Transition

July 7, 2025

New Financial Year, New Solar Reality

July 1, 2025

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.

It’s 1 July, and while businesses are busy wrapping up EOFY admin, a very different kind of reset is happening in the background. The economics…

READ MORE