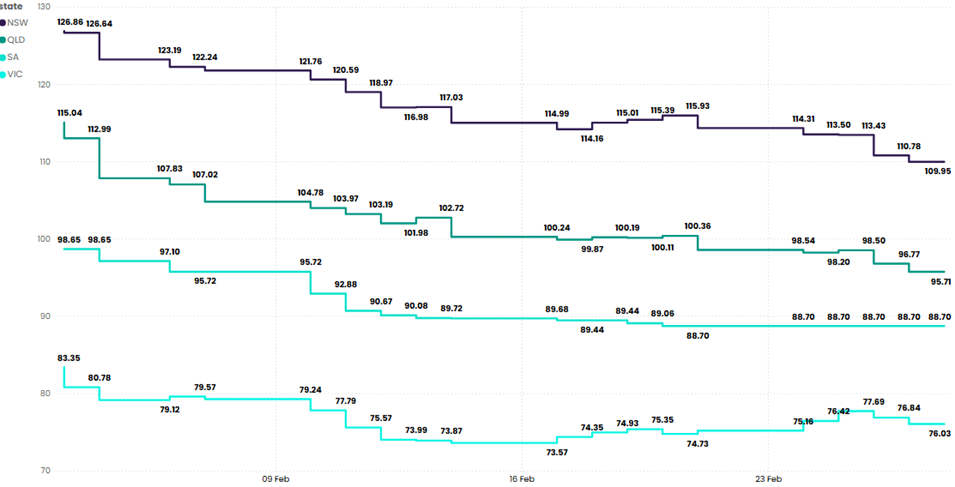

February and early March saw continued fluctuations in electricity futures prices across the National Electricity Market (NEM), with notable reductions in most states and sustained trends in negative pricing events, particularly in high-renewable regions.

Victoria and South Australia continued to experience frequent negative pricing events, underscoring the growing influence of renewables on wholesale electricity pricing dynamics.

As the share of renewables in both states increases, negative pricing events are expected to continue. This presents opportunities for businesses to adopt flexible energy procurement strategies, such as shifting consumption to off-peak times or investing in battery storage to optimise cost savings and mitigate the risks of future price volatility.

Wholesale gas prices remained steady in February, edging up by less than 1% compared to January 2024, suggesting minimal market volatility. However, the calm before the storm could be approaching, with ongoing regulatory discussions and global LNG demand shifts pointing to future volatility in gas markets.

ACCC's LNG Netback Price for 2025 decreased to $18.99 per GJ (~$1 per GJ decrease since Jan 25). This is still, however, well above our domestic gas prices.

Several factors could trigger gas price fluctuations in the coming months, including supply uncertainties, ongoing changes in domestic production levels, and international demand for LNG, which could affect local gas availability. As the Australian Competition and Consumer Commission (ACCC) notes, gas prices are expected to rise in the medium to long term due to factors such as the phasing out of legacy gas contracts and increasing global competition for LNG exports.

For businesses reliant on gas, it may be prudent to prepare for potential price volatility and consider hedging strategies or diversifying energy sources for the longer term. With gas prices projected to increase, securing long-term, competitive contracts or investing in alternative energy solutions could offer valuable cost control.

With electricity prices continuing to show variability across the NEM, businesses have an opportunity to lock in competitive energy contracts before prices rise further. However, the ongoing trend of negative pricing events in Victoria and South Australia highlights the potential for flexible procurement strategies, such as shifting consumption to times of lower pricing or adopting battery storage solutions to capture excess renewable energy.

Meanwhile, the stability of gas prices in February is expected to be short-lived, with volatility anticipated in the coming months. Regulatory uncertainty and supply challenges suggest that businesses should consider diversifying their energy mix, hedging against price increases, and staying agile in their energy procurement strategies to mitigate future risks.

Electricity prices are set to rise by up to 9% from July 2025, according to the Australian Energy Regulator's (AER) draft determination for the Default Market Offer (DMO). These increases are driven primarily by network charges, adding further strain on businesses already facing increasing operational expenses.

DMO (and the VDO in Victoria) impact small business and residential users of energy, so isn't expected to have a direct impact on large energy consumers.

Businesses should prepare for higher electricity costs in the coming months and explore ways to mitigate these increases. Reviewing energy contracts, improving efficiency, and considering fixed-rate deals may help stabilize expenses. Staying informed on market developments will be crucial to managing potential disruptions.

Victoria is facing an impending gas crisis, with industry leaders warning that years of underinvestment in gas supply have left businesses exposed to supply shortages and price spikes. The AFR reported that Beach Energy CEO Brett Woods and Woodside Energy CEO Meg O’Neill have cautioned that gas shortages will severely impact industries reliant on gas, including manufacturing, food production, and heavy industry.

Despite efforts by the Victorian state government to fast-track new gas projects, the reality is that bringing new supply online takes time. The Australian Energy Market Operator (AEMO) has already projected structural gas shortages by 2027, increasing the risk of price volatility and potential supply constraints across the east coast.

Businesses operating in Victoria, particularly in gas-intensive industries, should prepare for potential cost increases and supply disruptions in the coming years. Reviewing energy procurement strategies, exploring alternative energy sources, and engaging in long-term risk mitigation planning will be essential to managing exposure to price volatility. Keeping a close watch on policy developments and government intervention measures will also help businesses anticipate and adapt to future changes.

The Australian Energy Market Commission (AEMC) has confirmed updates to key reliability settings for the National Electricity Market (NEM), adjusting the Market Price Cap (MPC) and Cumulative Price Threshold (CPT) for the 2025-26 financial year. These changes, made in accordance with the National Electricity Rules, reflect CPI-based adjustments and the progressive increases introduced in December 2023.

The MPC represents the maximum price that can be reached in the spot market during any trading interval, while the CPT limits the total price that can accumulate over seven days. The adjusted values for 1 July 2025 – 30 June 2026 are:

These increases are part of a broader transition, with further scheduled rises through to 1 July 2027.

Look out for our blog post next week, where we’ll be breaking down the hidden costs of generators rebidding in the NEM.

The adjustments to the MPC and CPT signal ongoing changes to market price limits, which may lead to greater price volatility, particularly during peak demand periods. Businesses exposed to spot market pricing should assess their risk exposure and procurement strategies to manage potential cost fluctuations effectively. We recommend working closely with us to review your energy contracts and hedging strategies to ensure stability.

Rio Tinto has signed a 20-year agreement with Edify Energy to power its Gladstone aluminium operations with renewable energy and battery storage. This move is part of a broader trend of large corporations securing long-term renewable energy deals to reduce costs and emissions. The Australian government’s recent $2 billion investment in renewable energy for heavy industry further signals that more businesses will be encouraged to transition away from traditional energy sources.

For businesses, this highlights the growing importance of securing sustainable and cost-effective energy solutions. Companies that rely on energy-intensive operations should assess their exposure to future energy price fluctuations and consider whether renewable energy procurement or on-site generation could provide long-term benefits.

The Australian Renewable Energy Agency (ARENA) has announced $46.3 million in funding for Round 2 of the Community Batteries Funding Program, supporting the deployment of community-scale battery storage across Australia. These batteries will help store excess rooftop solar energy, reduce household energy bills, and ease pressure on the electricity grid.

Falling costs of battery energy storage systems (BESS) are making large-scale deployment more viable. This trend is improving the economics of distributed energy storage, allowing more communities and businesses to benefit from cheaper, more reliable renewable energy.

Businesses operating in areas with community batteries may see lower network costs and improved energy reliability, particularly those with rooftop solar. For those in the energy sector, declining battery costs and increased funding for storage projects present opportunities in grid services, demand-side management, and renewable integration. As battery storage becomes more cost-effective, businesses should explore how energy storage could help reduce costs and improve energy resilience.

Rising electricity costs, gas supply challenges, and evolving market regulations are reshaping Australia’s energy landscape. At the same time, opportunities in renewable energy procurement and battery storage are becoming more viable for businesses looking to stabilise costs and improve energy resilience.

If you’d like support in navigating these changes or want to explore how your business can optimise its energy strategy, get in touch with us. Our team is here to empower you with the insights and solutions needed to achieve the best available energy outcomes.

Can Yallourn Hold On Until 2028?

September 8, 2025

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.

The Coal Giant on Shaky Legs Yallourn Power Station has been keeping Victoria’s lights on for nearly a century. At its peak, six units pumped…

READ MORE