Australia’s electricity market is changing, and so are the rules that govern it.

In August 2025, a federal review panel chaired by energy economist Dr Tim Nelson, former AGL Chief Economist and now Executive General Manager at Iberdrola Australia, released its draft blueprint for reforming the National Electricity Market (NEM).

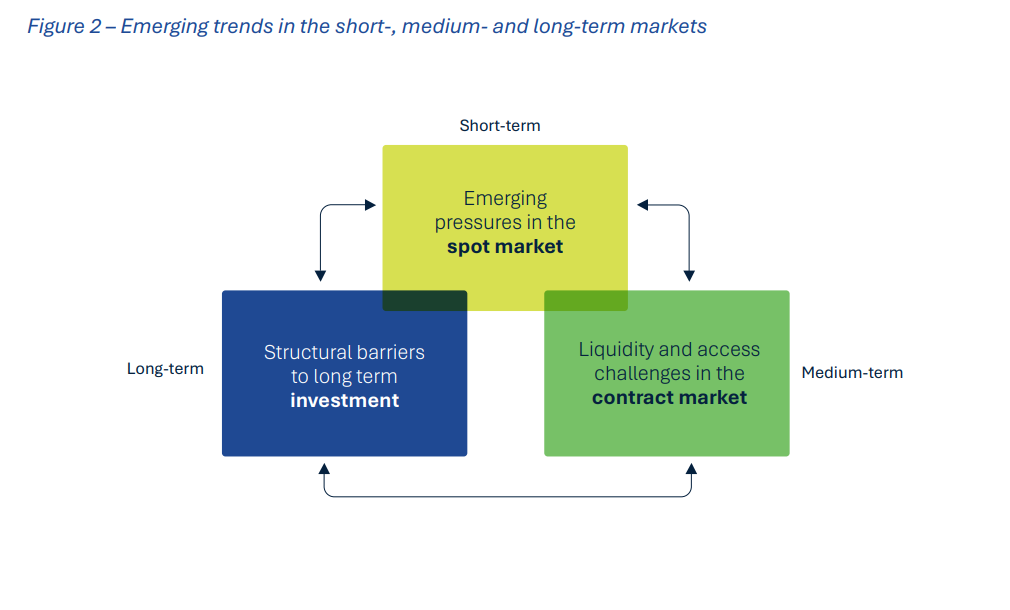

The Nelson Review, tackles a growing misalignment between dispatch, contracting, and long-term investment, a disconnect putting pressure on prices, reliability, and confidence.

At its core, the Review offers a pragmatic but urgent call for reform. Without it, challenges in the NEM will deepen. The Panel’s vision is a market that delivers stable prices, firmed renewables, fewer ad hoc interventions, and a nationally coordinated transition.

This isn’t about scrapping the current system, it’s about strengthening it. The proposed reforms aim to better connect short-term dispatch, medium-term risk, and long-term investment, giving energy buyers and sellers the confidence to plan ahead.

The NEM has served Australia well for decades. But the system is now being reshaped by three converging forces:

The result? Greater market risk, more pressure on firming, and a system struggling to send the right signals to get the right projects built in time.

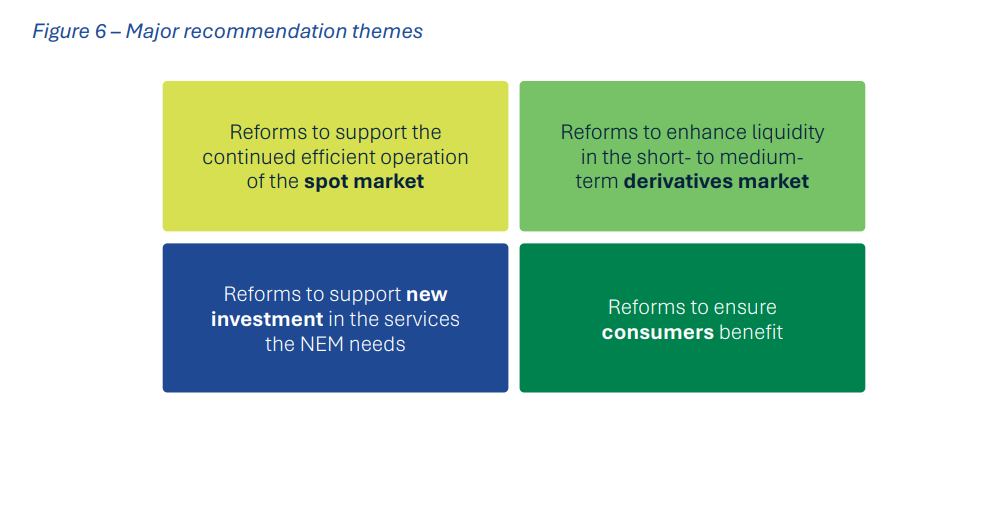

The review suggests that generators would continue to be paid only for what they produce, not for just being available. This is a crucial design feature for efficient pricing.

However, the report calls for more “visibility” and scheduling of behind-the-meter resources, like batteries and flexible demand, which are increasingly shaping the system but often sit outside of it.

What this means for business:

Expect greater emphasis on demand-side participation, including load flexibility, virtual power plants, and battery assets. Businesses with the ability to respond to price signals may see new value streams open up.

The review proposes a mandatory market-making obligation to improve contract liquidity, especially in regions where volatility is rising. A small set of standardised hedging contracts would be co-designed and made available to market participants at all times.

What this means for business:

A functioning forward contract market is critical for price certainty, not just for energy retailers but also for large buyers managing portfolio exposure. As this market has eroded, it’s become harder to secure competitive, multi-year pricing. These reforms aim to restore liquidity, standardise risk tools, and create more accessible hedging options for all participants.

The flagship reform is the Electricity Services Entry Mechanism (ESEM), a new way to offer long-term contracts to clean energy projects. It would only cover the later years of a project’s life, with the early years funded through normal market channels like PPAs or retailer deals.

In short, the government would help share long-term risk by underwriting part of the contract, then selling it back into the market. It’s not a subsidy, it’s a structural fix to help projects get financed.

What this means for business:

If implemented, the ESEM could stabilise forward prices over time and create a more bankable pipeline of new generation and firming. For buyers, it’s a potential path to more reliable contract options, and a market less prone to panic.

While the Nelson Review focuses heavily on investment and market design, it also puts consumers front and centre, aiming to make the market clearer, more stable, and fairer. Proposed changes include supporting simple, multi-year retail contracts to give price certainty, reforming network tariffs to better reflect wholesale dynamics, updating how benchmark prices like the Default Market Offer are set, and expanding protections to cover new services like batteries, virtual power plants, and aggregators.

What this means for business:

Particularly for large energy users and multi-site portfolios, this could create more stable retail offerings and better visibility of future costs. It also reflects a market shift where participating in energy, through storage, response, or flexibility, must come with appropriate protections and rewards.

The review is now open for consultation, with final recommendations due by the end of 2025. Meanwhile, the federal government is progressing its Capacity Investment Scheme, which is still expected to run through to 2030, overlapping with the proposed ESEM.

But several important questions remain:

Utilizer will continue monitoring developments and provide guidance as the final design is refined. These questions may seem technical, but the answers will shape the real-world cost, risk, and availability of energy contracts for years to come.

If you're unsure what these changes mean for your next procurement cycle, reach out. At Utilizer, we make energy easy, especially when the market doesn’t.

More Power to You.

Heatwaves and the Energy Market

January 13, 2026

Empower Your Business with Our Expert Energy Consulting Services

December 19, 2025

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.