AEMO’s 2025 Transition Plan for System Security lands at a critical moment in Australia’s energy transition. Renewable generation is scaling at world-leading speed. Rooftop solar continues to surge. Batteries and electrification are accelerating across every sector.

But the new plan makes one thing clear. The pace of investment in clean generation is now outstripping the pace of investment in the less visible foundations that actually keep the power system stable.

In other words, the energy transition is no longer constrained by renewable supply. It is constrained by system security.

Buried beneath the technical detail, AEMO sets out a blunt truth. Eraring cannot retire on time without significant risk to system security unless replacement infrastructure is delivered first.

If the required synchronous condensers are not operational when Eraring closes, AEMO warns of a series of cascading risks that go well beyond abstract engineering concerns.

Without Eraring’s stabilising force, voltage and frequency become harder to control. The grid becomes more fragile, and smaller disturbances have a greater chance of escalating.

AEMO would be forced to direct generators online or curtail renewable output simply to keep the system secure. These interventions are costly and distort normal market pricing.

If there are not enough remaining synchronous generators online, AEMO may have no viable unit to call on. This is when the system enters genuinely high-risk territory.

In extreme conditions, AEMO may need to activate emergency backstop mechanisms or take actions designed solely to avoid cascading outages. These are tools the operator never wants to us

This is why media reports have stated that Eraring “cannot retire without risking blackouts”. It's not political commentary. It's the technical conclusion AEMO reaches when the exit of a major coal plant outpaces the delivery of the infrastructure that replaces the stability services it provides.

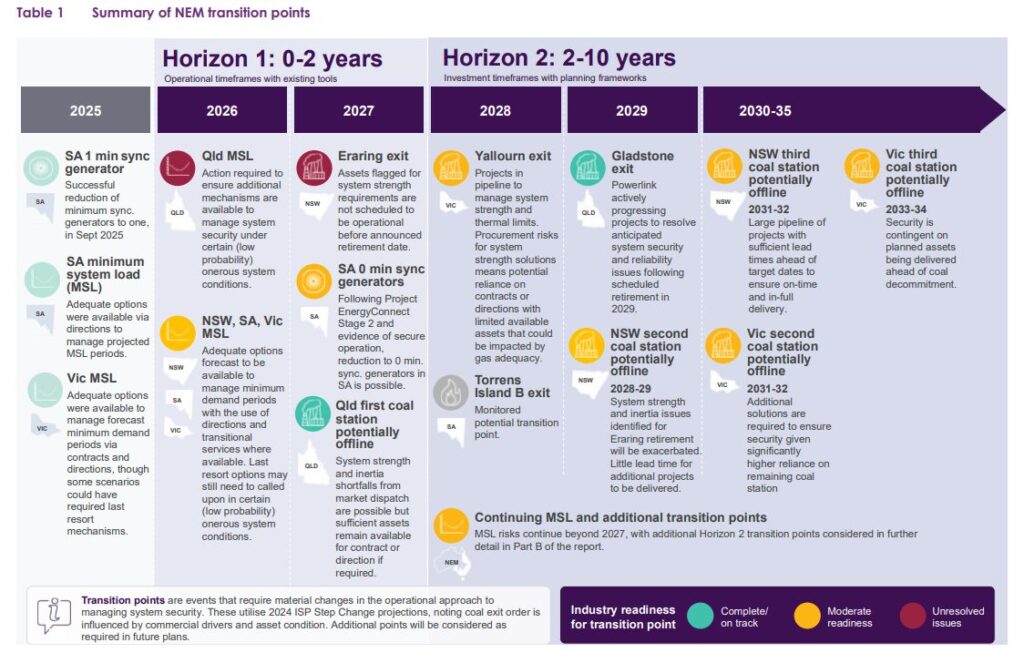

AEMO maps the decade ahead through key transition points. These are moments where the system must operate differently because a major generator retires or a new stability service is required.

Here is the timeline AEMO sets out:

Source: AEMO 2025 Transition Plan for System Security

For businesses, none of this means instability is inevitable. It means the system is entering a tightly sequenced period where infrastructure delivery, commissioning and testing must align precisely with generator retirements. When that alignment slips, market conditions shift.

For a decade, the challenge was how to add more renewable energy. Today, the challenge is how to replace the essential stability services that coal once provided as a by-product of simply being online.

These services include:

The grid must keep voltage steady when something changes unexpectedly, such as a line tripping or a cloud bank crossing a solar farm. Coal units do this naturally through their spinning machines. In a renewable grid, voltage stability must be engineered through alternative technologies.

Inertia slows the rate at which frequency changes after a fault. Without it, the system can swing too fast for protection and control systems to respond. Low inertia is one of the defining risks of a high renewables grid.

If the system ever goes dark, operators need assets that can start without external supply and re-energise the grid. Historically this came from hydro and a handful of gas units. In the future it must come from batteries, hybrid systems or grid-forming inverters that can restart the system in new ways.

Grid-forming batteries do not follow the grid. They help create it. They can set voltage and frequency, stabilise the system after disturbances and eventually provide system strength and inertia. The system needs them at scale, not as isolated trials.

Transmission is not just about transporting power. It also carries the stability, strength and redundancy that coal stations currently anchor. If transmission upgrades arrive late, the system becomes bottlenecked and increasingly reliant on ageing plant that may withdraw with limited notice.

AEMO’s analysis shows progress across all regions, but also exposes where gaps remain:

The technical shift is underway, but the system is relying on assets still being built or commissioned. The risk is not the transition itself. The risk is the timing.

System security is often framed as a technical challenge, but its effects show up in very commercial ways. When the grid operates closer to its stability limits, the market adjusts. Retailers price in more risk. Contract availability tightens. Volatility spreads into forward curves. Interventions add cost to the market. Procurement windows shrink or shift.

Regardless of whether a business understands the engineering behind system security, it is exposed to its consequences. These conditions shape:

This is why system security is no longer just an issue for generators or policymakers. It directly affects how businesses plan, budget and manage exposure.

The transition will reward organisations that plan proactively, read market signals early and understand where the risks and constraints sit. The strongest outcomes will go to businesses that can connect technical realities with commercial strategy rather than treating them as separate conversations.

At Utilizer, this is exactly our role. We simplify the complexity of the market, monitor the underlying system conditions and translate them into clear, actionable decisions. The aim is always the same: to give leaders confidence, not guesswork, in a market that is moving quickly. Reach out to our energy experts today and we'll show you a better way.

Heatwaves and the Energy Market

January 13, 2026

Empower Your Business with Our Expert Energy Consulting Services

December 19, 2025

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.