Australia’s energy market closed out 2024 with a series of notable developments, setting the stage for an eventful year ahead. As we step into 2025, staying ahead of these changes is key to making informed energy decisions. At Utilizer, we break down the latest updates and what they mean for your business—helping you navigate risks, capitalise on opportunities, and optimise your energy strategy.

As 2024 drew to a close, energy prices across the NEM displayed significant regional variations and trends:

Source: ASX Energy Futures

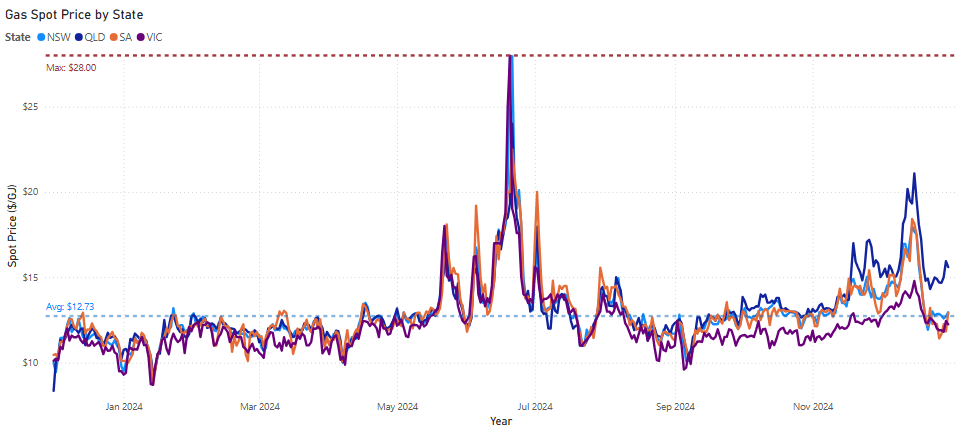

Source: AEMO STTM and DGWM Spot Market Data

Electricity and gas markets experienced notable shifts in December, with rising prices in most regions, elevated gas spot prices, and increased renewable-driven negative pricing events. Navigating this evolving landscape requires understanding these trends and diversifying your energy strategy. Utilizer helps you stay ahead by monitoring price movements, securing flexible contracts, and exploring renewable and storage solutions to optimise costs and build resilience in a competitive market.

On December 30, 2024, the Australian Competition and Consumer Commission (ACCC) released its twelfth report on electricity prices, profits, and margins within the National Electricity Market (NEM). The report delves into market dynamics and pricing trends, offering valuable insights for businesses aiming to manage energy costs.

Key Takeaways:

What does this mean for you?

Understanding the ACCC's findings is crucial for anticipating pricing trends and refining your procurement strategy. At Utilizer, we help you navigate these complexities by providing insights into market dynamics and regulatory changes. With our expertise, you can make informed decisions to optimise energy costs, secure competitive contracts, and build a more resilient energy strategy for your business.

In mid-December, the Australian Energy Regulator (AER) published its State of the Energy Market 2024 report, providing a detailed analysis of all National Electricity Market (NEM) regions. The report highlights significant developments since 2022, including changes in pricing, market structure, and participant behaviour across various regions.

Key Takeaways

What does this mean for you?

Navigating market volatility, coal plant reliability issues, renewable energy growth, and shifting market structures is essential for businesses in the evolving energy landscape. By working with Utilizer, businesses can secure flexible energy contracts, diversify strategies to mitigate risks from ageing infrastructure, and leverage opportunities in renewable procurement and battery storage.

Australia is experiencing an unprecedented rate of renewable energy installation, with solar and wind being deployed at a pace three times faster than all other new electricity sources combined, according to PV Magazine. This rapid expansion is reshaping the energy market and creating new opportunities for businesses.

What does this mean for you?

Businesses have the opportunity to leverage the expanding renewable energy market by investing in sustainable energy solutions. Adopting renewable energy can not only reduce carbon footprints but also provide cost advantages in the long term, aligning with global sustainability trends and consumer expectations.

Tamboran Resources and APA Group have agreed to construct the $66.5 million, 37 km Sturt Plateau Pipeline, connecting the Beetaloo Basin's gas assets to the north-south Amadeus pipeline. This project aims to enhance energy security in the Northern Territory and support the region's energy transition, with operations expected to commence by early 2026.

What does this mean for you?

For businesses reliant on gas, this development could provide greater stability and security in supply from 2026. At Utilizer, we closely monitor projects like this to keep you informed of key milestones and their potential impact on the energy landscape. By partnering with us, you can align your energy planning and procurement strategies to secure reliable and cost-effective supply options for the future.

Developers of new gas peaking plants on Australia's east coast are facing challenges due to market volatility and the absence of capacity payments, unlike their counterparts in Western Australia. The Australian Energy Market Operator's (AEMO) projections indicate a need for increased gas generation capacity, yet uncertainties remain regarding market reforms and future demand.

What does this mean for you?

Businesses should be aware of potential shifts in energy availability and pricing due to these developments. We can support you in navigating these uncertainties by identifying opportunities to diversify your energy sources and invest in flexible solutions. With our expertise, you can build resilience in your energy strategy, ensuring stability and cost efficiency even in a changing market.

Australia’s energy sector continues to evolve, shaped by regulatory changes, market dynamics, and infrastructure challenges. Staying ahead of these developments is key to managing costs, ensuring reliability, and identifying opportunities in an increasingly complex market. Utilizer is here to provide the insights and strategic support you need to make confident energy decisions—helping you optimise costs, enhance sustainability, and future-proof your operations.

If you’d like to explore how these market changes could impact your business and discover strategies to optimise your energy approach, speak to one of our energy experts today.

New Financial Year, New Solar Reality

July 1, 2025

ACCC Warns of East Coast Gas Shortfall

June 30, 2025

As Gas Usage Falls, Who Pays for the Pipes?

June 27, 2025

Explore our monthly market wraps for a comprehensive outlook on the Australian energy market, and start making smarter energy decisions.

Australia’s gas industry is at a crossroads. As more households and businesses make the switch to electric appliances, the country’s vast gas pipeline network faces…

READ MORE